When you operate an accounting firm of 20 people or more, you can’t undermine the importance of efficiency, accuracy, and seamless collaboration in your operations. For firms seeking a robust solution to streamline these processes, CCH Axcess offers a modern, comprehensive approach tailored to the needs of tax and accounting professionals.

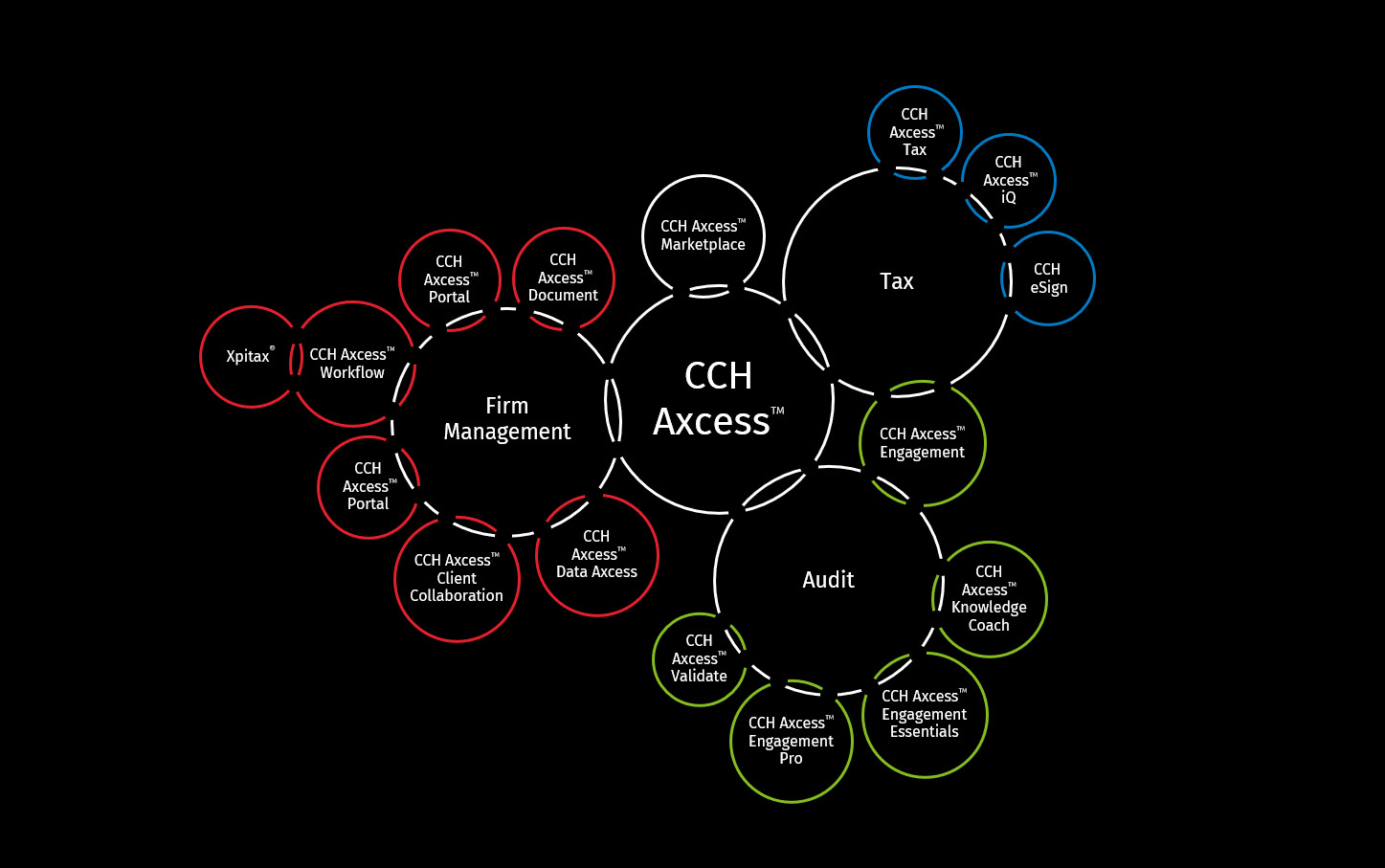

Developed by Wolters Kluwer, CCH Axcess is a cloud-based platform that integrates a suite of tools to handle tax preparation, document management, workflow optimization, and client collaboration. Its modular design enables firms to customize the platform to fit their specific requirements, delivering flexibility, enhanced productivity, and better results.

This article will help establish a common understanding of CCH Axcess, whether your firm is new to the platform or looking to optimize its implementation. By the end, you’ll gain actionable strategies to improve your processes and deliver greater value to your clients.

Recent Recognitions of CCH Axcess

CCH Axcess has earned widespread recognition for its innovative solutions and impactful contributions to the accounting industry. Some of its notable accolades include:

- 2020 Golden Bridge Awards: CCH Axcess Client Collaboration won a Gold Award in the Collaboration and Web Tools Innovation category.

- 2021 American Business Awards: CCH Axcess Knowledge Coach and CCH Axcess Financial Prep were honored with Stevie Awards for their excellence in supporting the industry.

- 2022 AI Excellence Award: CCH Axcess Financial Prep end-to-end trial balance solution won this award for its use of AI and machine learning

- 2023 BIG Artificial Intelligence Excellence Award: CCH Axcess Engagement suite won this award for its use of artificial intelligence

- 2023 ABA Stevie Awards: CCH Axcess Engagement suite won a bronze award for Compliance Solutions

- 2023 Globee Business Awards: CCH Axcess Engagement suite won a gold award for Governance, Risk & Compliance Solution

- 2024 BIG Innovation Awards: CCH Axcess Tax won this award

These awards highlight CCH Axcess as a trusted, industry-leading platform that continues to drive innovation and efficiency for accounting professionals worldwide.

The Key Components of CCH Axcess

- CCH Axcess Tax is a specialized tool designed for tax preparation and filing, with the ability to automate processes from calculations to error checks. This tool helps eliminate most manual data entry steps, reducing the risk of mistakes and saving time for accounting teams. Today, accounting firms use this module to handle complex tax forms while ensuring compliance with legal regulations, all without requiring an excessive workforce.

- CCH Axcess Workflow provides a project and workflow management solution, helping track progress and allocate tasks efficiently. This tool allows managers to closely monitor activities within the firm, from small projects to more extensive processes, ensuring everything stays on track. With this feature, accounting firms can quickly identify issues early on and adjust resources accordingly, ultimately improving overall productivity.

- CCH Axcess Practice optimizes time and cost management, helping firms track employee working hours and accurately bill clients. This tool is invaluable for accounting firms to efficiently manage cash flow while boosting profitability by automating administrative tasks. In practice, companies use this module to focus more on customer service, minimize manual work, and enhance the value they provide.

- CCH Axcess Workstream: a cloud-based accounting software that helps firms manage projects and coordinate their daily work, manage projects, monitor due dates, and map processes into standardized steps

Workflow automation: Automate workflows, use dashboards, notifications, and project pools. It also provides extensive budgeting capabilities: to manage budgets at the project level as well as workstep level, and directly integrates to the Time Entry function within CCH Axcess Practice. - CCH Data Axcess Utility: This module allows users to extract client, project, and billing data from their CCH Axcess system into a local SQL database, enabling them to create custom reports, integrate with third-party business intelligence platforms, and analyze their firm data more effectively using tools like Power BI; essentially acting as a bridge to pull data out of CCH Axcess for further analysis outside the platform itself.

- CCH Axcess Engagement is designed to support audit projects and financial reporting through a centralized management platform. With cloud-based data storage and processing capabilities, this tool allows audit teams to collaborate and share information seamlessly, regardless of physical location. This module accelerates processes, reduces wait times, and improves overall efficiency for firms that regularly conduct audits or prepare financial statements.

- CCH Axcess Document is a secure document management system that allows for the storage, organization, and easy access to client documents. Data loss or corruption is reduced because all essential documents are safeguarded in a cloud environment. Accounting firms value the tool’s fast search capabilities and logical document management features, especially when dealing with audits or requests from tax authorities.

How to Maximize CCH Axcess For Your Work

According to the eBook by Wolters Kluwer, “How Tax and Accounting Firms Supercharge Efficiency with a Digital Workflow,” CCH Axcess is designed to address the challenges accounting firms face in their workflows. By integrating automation and cloud-based tools, the platform simplifies data collection, reduces manual entry, and enhances review processes, ensuring firms operate more efficiently and effectively.

Challenge #1: Disorganized Data Collection

Efficient data collection is a critical first step in delivering client services, yet it remains one of the most time-consuming tasks for firms. Challenges include managing large volumes of data, collecting information from various sources, and dealing with disorganized workflows. These inefficiencies lead to lost time, repeated client follow-ups, and frustrated staff. The Solution? CCH Axcess provides a common data model in the backend that integrates to its many functional modules, and automated tools to streamline the data collection process.

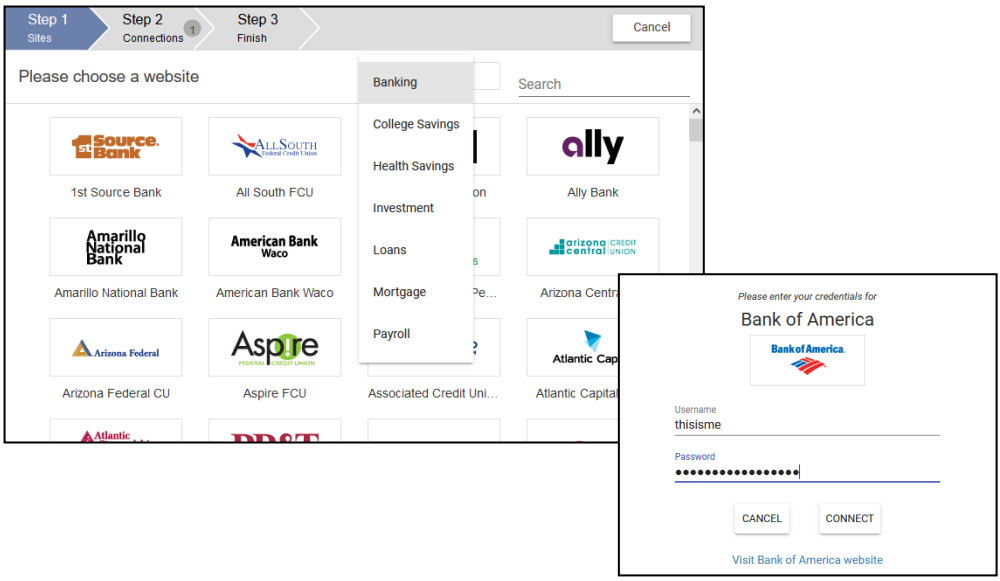

- Efficient Client Collaboration

CCH Axcess™ Client Collaboration provides a secure platform where clients can directly connect their banking data and submit required documents. Clients are guided with clear checklists, ensuring they know what to submit and can track their progress. This structured approach minimizes back-and-forth communication.

- Digitized File Scanning

CCH® ProSystem fx® Scan Funnel eliminates inefficient data entry process for most common government forms and “print-then-scan” workflows by consolidating digital files from various formats into a single organized PDF. This reduces time spent handling documents and enhances accessibility for the team. Using AI-driven document recognition, CCH ProSystem fx Scan identifies, classifies, and bookmarks scanned documents.The system organizes them into well-labeled PDFs, allowing administrative staff to process documents efficiently without requiring tax expertise. Standardizing workflows across engagements ensures consistency, reducing errors and improving productivity.

Challenge #2: Excessive Manual Data Entry

After data is collected, the task of entering it into tax systems consumes significant time and resources. Manual entry not only delays processes but also introduces errors and reduces job satisfaction for professionals. The Solution? Automating Data Entry with CCH Axcess.

- Automated Data Extraction and Import

CCH ProSystem fx Scan and AutoFlow Technology extract relevant data from scanned forms, including W-2s, 1099s, and K-1s. This data is automatically validated and imported into the correct fields within tax returns, reducing manual input effort.

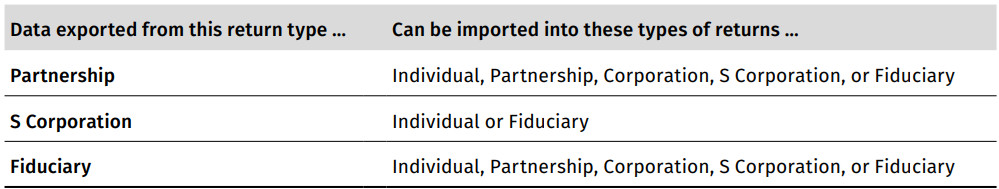

For example, the AutoFlow Wizard uses taxpayer IDs to match extracted data to existing returns, ensuring accuracy and speeding up the process. - Data Sharing Across Related Returns

For clients with multiple entities, data sharing between related returns saves significant time. For example, K-1 data can be exported, updated in Excel, and re-imported seamlessly into connected returns. Live links ensure changes in source data are reflected across all related filings.

“Using CCH ProSystem fx Scan and AutoFlow, we’ve saved an enormous amount of time… I would estimate easily half an hour per 1040” (Healy, as cited in Wolters Kluwer, 2023, p. 14).

- Business Returns Integration

Business clients can connect trial balances from accounting tools like Xero™ or QuickBooks® Online to CCH Axcess Tax, which automatically maps data to tax returns. Machine learning ensures proper classification and groupings, minimizing the need for manual adjustments.

Challenge #3: Inefficient Paper-Based Reviews

Traditional review processes rely on printing, routing, and re-entering information, which slows workflows and leads to bottlenecks. These delays reduce realization rates and frustrate both staff and clients. Solution: Optimized Digital Review Tools.

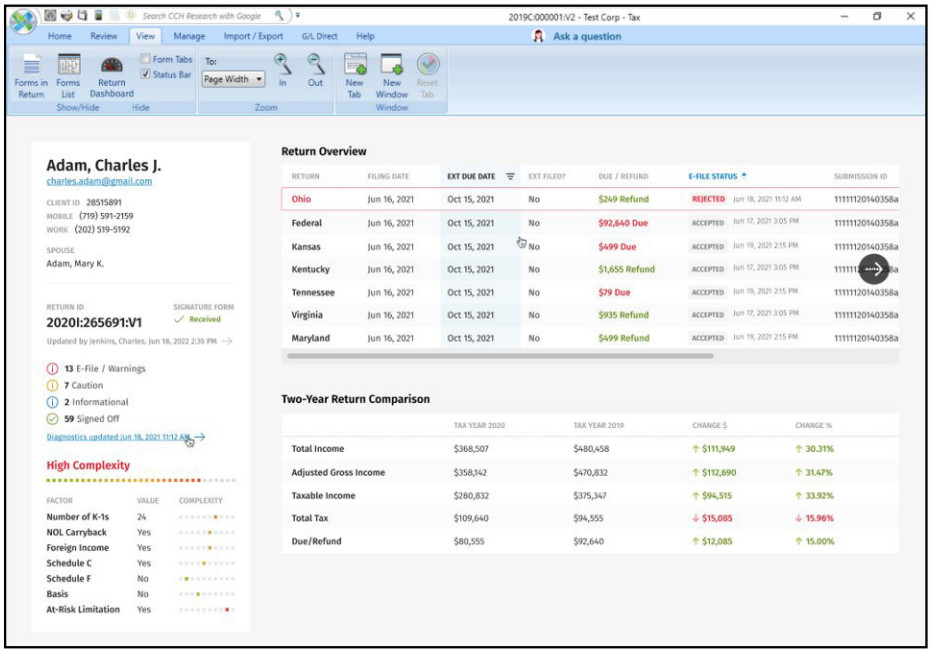

- Centralized Review Dashboards

The CCH Axcess Tax Return Dashboard centralizes all critical information, such as filing dates, e-file statuses, and diagnostics. With tools like two-year comparisons and complexity scoring, reviewers can quickly focus on high-risk areas, ensuring compliance and accuracy.

- Collaborative On-Screen Reviews

CCH Axcess Tax includes robust collaboration features, such as preparer and reviewer notes, tick marks, and linked global notes. These tools enhance communication and simplify the review process. For PDF-based reviews, the CCH® ProSystem fx® PDFlyer add-on enables detailed mark-ups, annotations, and summaries.

As detailed by Wolters Kluwer (2023) in “How Tax and Accounting Firms Supercharge Efficiency with a Digital Workflow,” CCH Axcess empowers firms to overcome operational challenges with automation, integration, and cloud capabilities. By improving data collection, minimizing manual data entry, and streamlining reviews, firms can enhance productivity and focus on delivering high-value services. This platform positions firms to stay competitive while meeting client needs efficiently.

Silver Sea Analytics: CCH Axcess Optimization Solutions for Auditing Firms

Whether your firm is already using CCH Axcess or considering its implementation, optimizing this powerful platform can revolutionize your operations, enhance efficiency, and deliver exceptional client experiences. At Silver Sea Analytics, we specialize in helping accounting firms unlock the full potential of CCH Axcess, turning challenges into opportunities for growth.

Since 2016, we’ve been a trusted partner for over 20 accounting firms across the U.S., providing tailored solutions that:

- Streamline workflows through optimized configurations.

- Seamlessly integrate systems for continuous, efficient data flow.

- Deliver actionable insights with real-time analytics dashboards to drive better decisions.

Don’t let challenges or inefficiencies slow you down. Let us guide you in transforming CCH Axcess into a powerful strategic asset, boosting your team’s performance, enhancing client satisfaction, and helping your firm stand out in a competitive market.

👉 Contact Silver Sea Analytics today for a free consultation and take the first step toward unlocking your firm’s full potential with CCH Axcess!

References

Wolters Kluwer. (2023). How tax and accounting firms supercharge efficiency with a digital workflow. Retrieved from https://wolterskluwer.com